Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

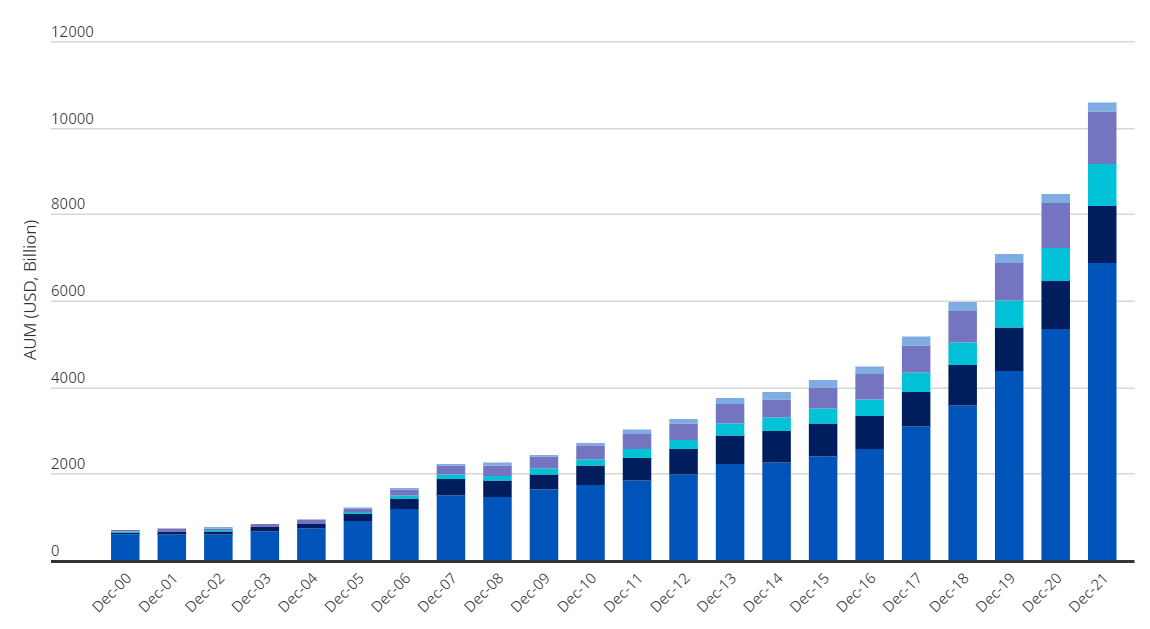

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

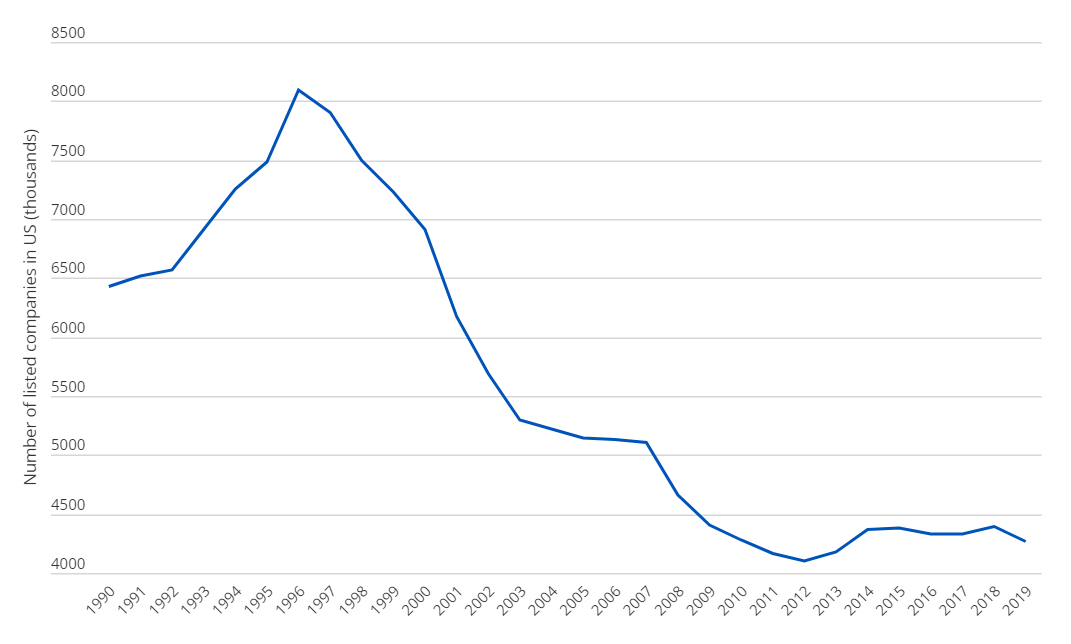

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

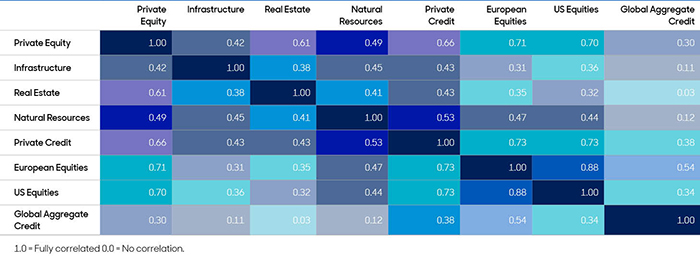

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at aberdeendiversified.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at aberdeendiversified.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

Figure 1: The phenomenal growth of private markets

Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at aberdeendiversified.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

Figure 2: Shrinking public markets, US companies

Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at aberdeendiversified.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at www.abrdndiversified.co.uk/ or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.

The opportunity set across industries such as health care, food and finance is vast.

Today’s macroeconomic backdrop is characterised by rising inflation, higher interest rates, and slowing growth.

As investors review their options in this era of uncertainty, we take a look at whether an allocation to private markets has the potential to enhance portfolio resilience and bolster returns.

Growth across private markets

Before we assess the benefits of investing in markets such as real estate, infrastructure, private equity, and private credit, it’s worth a reminder of the size and importance of these asset classes in today’s investment landscape.

Private markets have grown phenomenally in the last two decades, in some cases overtaking public markets. Figure 1, below, demonstrates the substantial growth in private markets, with assets under management now over $10 trillion as at the end of 2021, compared to the noticeable trend of shrinking public markets.

Figure 1: The phenomenal growth of private markets

Source: Preqin September 2022

Meanwhile, Figure 2, below, shows a drastic decline in the number of public companies across the United States. With many businesses choosing to remain private for longer, investors seeking exposure to fast-growing and innovative companies are looking for opportunities across private markets.

Figure 2: Shrinking public markets, US companies

Source: World Bank Data Set, most recent data, 2019.

Managing risk through diversification

As we have seen in the charts above, private market assets are no longer niche investments. On the contrary, they are set to become an increasingly important feature in diversified portfolios.

Recent market volatility has shown that the relationship between equities and bonds is not as uncorrelated as previously thought. Consequently, investors are questioning the traditional portfolio allocation of 60% equities and 40% bonds. Many are breaking this 60/40 mould in pursuit of more diversified portfolios, with one increasingly popular option being an allocation to private markets.

A question of correlation

When it comes to building a diversified portfolio, an awareness of the correlation between assets is essential. Figure 3 below demonstrates that private markets have a low correlation to public markets.

Figure 3: Private market vs public market correlation

Source: Private Market Data: Burgiss March 2000- March 2022, Public Market Data: Refinitiv Eikon March 2000- March 2022, MSCI Europe (USD) Total Return Index, S&P 500 (USD) Total Return Index, Bloomberg Global Aggregate Credit (USD) Total Return

Furthermore, as evidenced in Figure 2, the opportunity to diversify across public markets is becoming smaller. Large cap companies dominate public markets, with the top five companies accounting for 22% of the S&P 500 , meaning that risk and return is concentrated across these key players.

We believe that as more companies stay private for longer, an allocation to private markets can provide a real source of diversification to portfolios.

Identifying opportunities amid uncertainty

As well as improving diversification, an allocation to private markets can potentially enable investors to better tap into the opportunities offered by long-term structural growth trends.

The opportunity set across industries such as health care, food and finance is vast.

The Covid-19 pandemic accelerated many of these trends and highlighted the need for technology advancements. The opportunity set across industries such as health care, food and finance is vast, with technological innovation playing a significant role in the growth of economies and industries.

Alongside the transition to low-carbon economies and the achievement of net zero targets, the importance of energy independence and security has grown in significance in light of the war in Ukraine. In order to achieve these targets, a significant increase in investment in renewable energy and energy efficient technologies will be required to drive efficiency, reduce emissions and secure energy supply. Investing directly into this theme is made possible through private markets such as renewable infrastructure and private credit funding across new plant technology and innovative renewable solutions. Investors can potentially strengthen the climate change resiliency of their portfolios through such positions.

Demographic change

Lastly, populations in developed markets are becoming more elderly in contrast to those in emerging markets. As populations age, consumer demand will shift to services, particularly healthcare, with a greater focus on sustaining wellbeing.

We saw faster mobile and digital health advancements during the pandemic, which expedited the need for telehealth, virtual consultations and e-pharmacy. To support economies with younger populations, investment in urban development and infrastructure will be crucial. We foresee considerable opportunity across transportation systems, utilities and in social infrastructure, such as schools and hospitals.

Allocation to infrastructure, real estate and natural resources will allow investors direct exposure to these themes, and the ability to take advantage of the demographic changes across developed and emerging markets.

Final thoughts

As uncertainty across the geopolitical and economic environment continues, we believe building a resilient portfolio through diversification will be key to navigating market volatility.

An allocation to private markets is one way to add more diverse sources of return to client portfolios. That said, given the complexity of these markets, selectivity, scrutiny, experience, and skill are required in order to identify assets that tap into long-term structural drivers of growth in a meaningful way.

Important information

Risk factors you should consider prior to investing:

- The value of investments, and the income from them, can go down as well as up and investors may get back less than the amount invested.

- Past performance is not a guide to future results.

- Investment in the Company may not be appropriate for investors who plan to withdraw their money within 5 years.

- The Company may borrow to finance further investment (gearing). The use of gearing is likely to lead to volatility in the Net Asset Value (NAV) meaning that any movement in the value of the company’s assets will result in a magnified movement in the NAV.

- The Company may accumulate investment positions which represent more than normal trading volumes which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- There is no guarantee that the market price of the Company’s shares will fully reflect their underlying Net Asset Value.

- As with all stock exchange investments the value of the Company’s shares purchased will immediately fall by the difference between the buying and selling prices, the bid offer spread. If trading volumes fall, the bid-offer spread can widen.

- Yields are estimated figures and may fluctuate, there are no guarantees that future dividends will match or exceed historic dividends and certain investors may be subject to further tax on dividends.

- Derivatives may be used, subject to restrictions set out for the Company, in order to manage risk and generate income. The market in derivatives can be volatile and there is a higher than average risk of loss.

- The Company may invest in alternative investments (including direct lending, commercial property, renewable energy and mortgage strategies). Such investments may be relatively illiquid and it may be difficult for the Company to realise these investments over a short time period, which may make it difficult to realise investments and may lead to volatility in the market price of the Company’s shares.

- Investing globally can bring additional returns and diversify risk. However, currency exchange rate fluctuations may have a positive or negative impact on the value of investments.

Other important information:

Issued by Aberdeen Asset Managers Limited, registered in Scotland (No. 108419), 10 Queen’s Terrace, Aberdeen AB10 1XL. Authorised and regulated by the Financial Conduct Authority in the UK. An investment trust should be considered only as part of a balanced portfolio.

Find out more at aberdeendiversified.co.uk or by registering for updates. You can also follow us on social media: Twitter and LinkedIn.